Calculate your housing loan

Think about how much money you need and how much you can borrow. Based on that, choose the amount, repayment period and interest rate (fixed or variable) and calculate your loan.

-

Monthly installmentEUR

- Loan amount - EUR

- Amount to repay - EUR

- Tenor - -

- Interest rate Fixed interest rate - %

- APRC - %

- Total costs - EUR

-

Monthly installmentEUR

- Loan amount - HRK

- Amount to repay - HRK

- Tenor - -

- Interest rate Fixed interest rate - %

- APRC - %

- Total costs - EUR

How to get a favorable housing loan?

First steps to housing loan online

Submitting a housing loan application online allows you to make it easier to take out a housing loan, as you can do most of the steps in the process right from your home. You can:

- choose an appointment for a video chat with our counselors and consult on one of the most important life decisions from the comfort of your home,

- obtain more detailed information on credit and creditworthiness,

- find out what documentation you need to provide us according to your specific demand and employment status,

- users of the new online and mobile bank, who were previously identified, can submit a loan application and other documentation related to the loan.

Become our client

Need consulting?

Together with you, we will find the best solution regarding:

- the optimal way to secure your home loan,

- expected fees considering the amount borrowed and the type of pledged security,

- the most suitable way to pay the monthly instalments,

- existing options and conditions to pay off the loan before end of contract,

- choosing between variable and fixed interest rates.

Basic information about housing loan

- Loan amount: It depends on your creditworthiness, the value of the property or investment in it, your own interest and the type of loan insurance.

- Loan insurance: by pledging real estate, by paying an insurance premium with an insurance company.

- Repayment: normally loan is repaid from the salary (by transfer of the employer on the basis of an administrative disbursement ban).

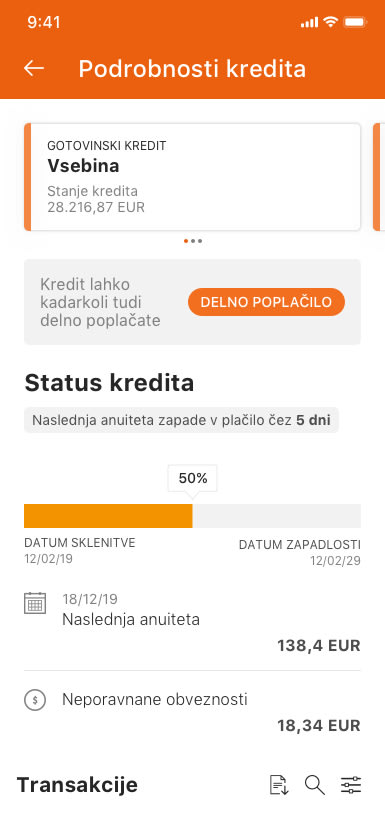

- Early repayment: you can repay the loan in part or in full at any time before the contractual deadline.

- Interest rate: you can choose between variable or fixe interest rate.

edit data

edit data